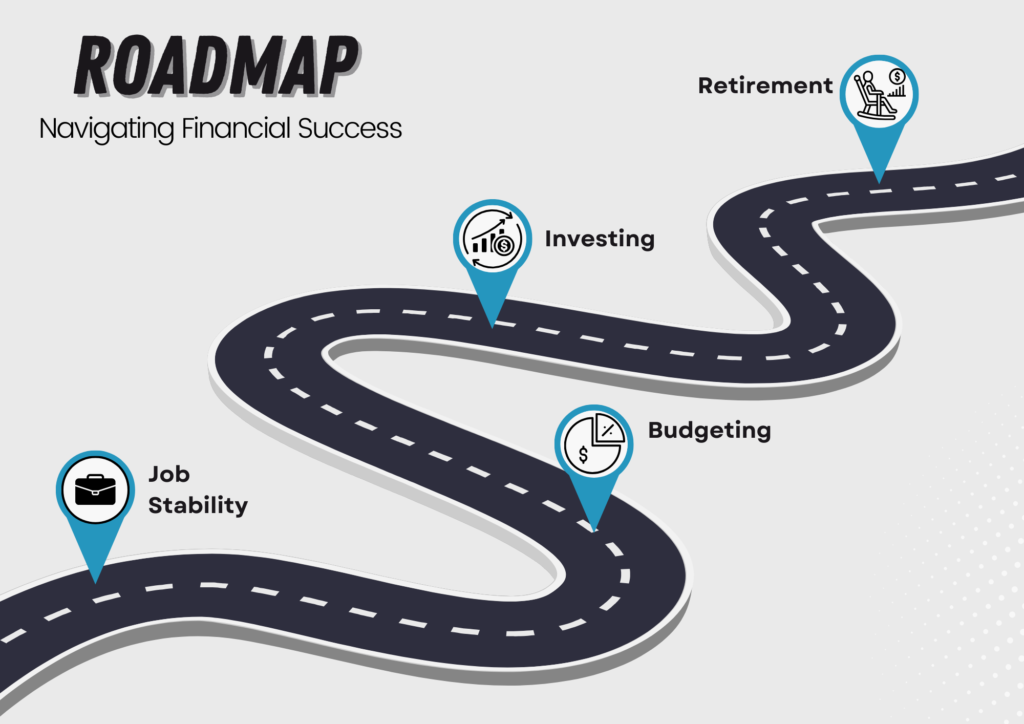

Roadmap: Navigating Financial Success

Roadmap: Navigating Financial Success is a financial literacy program that will enhance the youth’s knowledge of budgeting and financial responsibility. Through interactive workshops and engaging activities, scholars will gain a comprehensive understanding of banking, budgeting, credit scores, taxation, insurance, investment, and retirement planning.

A budget tells us what we can’t afford, but doesn’t keep us from buying it.

William Feather

Career Clusters and Career Interest Survey

Before the students participate in our money simulation game, we will guide them through a career interest survey. Ultimately, a career interest survey is a tool that measures your interests and helps you evaluate potential careers or your college major. This assessment will give students the insight to determine what field fits them for the game and potentially real life. We will also introduce the concept of career clusters. A career cluster is a group of occupations with similar features. A great example of a career cluster would be if someone is interested in sales and cars. The jobs suggested for that individual would be car salesperson or auto sales manager. Introducing students to these fundamental concepts can foster self-assessment regarding their areas of interest and instill a feeling of autonomy.

Roadmap Game Workshop

The workshops will simplify complex financial concepts into digestible lessons suitable for children. Participants will learn the importance of managing money responsibly, setting budgets, and making informed financial decisions. The program features a dynamic money simulation game where children can apply their newfound knowledge in a realistic setting. Through this interactive experience, participants will navigate financial scenarios, make purchasing decisions, and learn about the consequences of their choices. This approach emphasizes hands-on learning to ensure active engagement and comprehension. Children will practice skills such as opening bank accounts, calculating expenses, understanding credit, and exploring investment options. Every child’s financial journey is unique however, Roadmap offers personalized guidance and support to help children identify their financial goals, develop effective saving strategies, and plan for their future financial security.

Black Americans make up 30.87% of the poverty rate in Mississippi which is the second highest in the country.

World Population Review

Impact on Scholars

By equipping scholars with fundamental financial knowledge and skills at an early age, Roadmap: Navigating Financial Success empowers them to make sound financial decisions throughout their lives. Participants will learn practical skills essential for financial independence and success in adulthood. Roadmap: Navigating Financial Success aims to not only foster a culture of financial literacy and empowerment but also provide a fun, interactive, and impactful learning experience that sets children on the path to financial success and stability. By investing in their financial education today, students are empowered to build a brighter tomorrow for themselves and their communities.

The Importance of Roadmap

According to Wise Voter in 2023, Mississippi is the poorest state in the country with 18.70% being in poverty. According to the Census Bureau that percentage was increased to 19.20% in 2022. Roadmap: Navigating Financial Success allows young scholars to learn how to manage and balance a budget in real time. Unfortunately, these problems stem from financial illiteracy. Only 36% of Gen Z (Ages 11-26) are financially literate.

Our scholars are young, smart, and creative thinkers. The rates of financial illiteracy are not due to ineptness from students. Financial illiteracy is directly due to children and teenagers not having access to resources that are beneficial to their financial development. Through Roadmap: Navigating Financial Success, we will offer those resources in a fun and highly interactive way.